Recognizing Deferred Revenue

Deferred revenue is recognized on the Fiscal Period. Best practice is to recognize deferred revenue once per month, at the end of the month.

Note: For revenue to be deferred, deferral must be set up on the price record. See Setting Prices as Deferred.

To recognize deferred revenue:

-

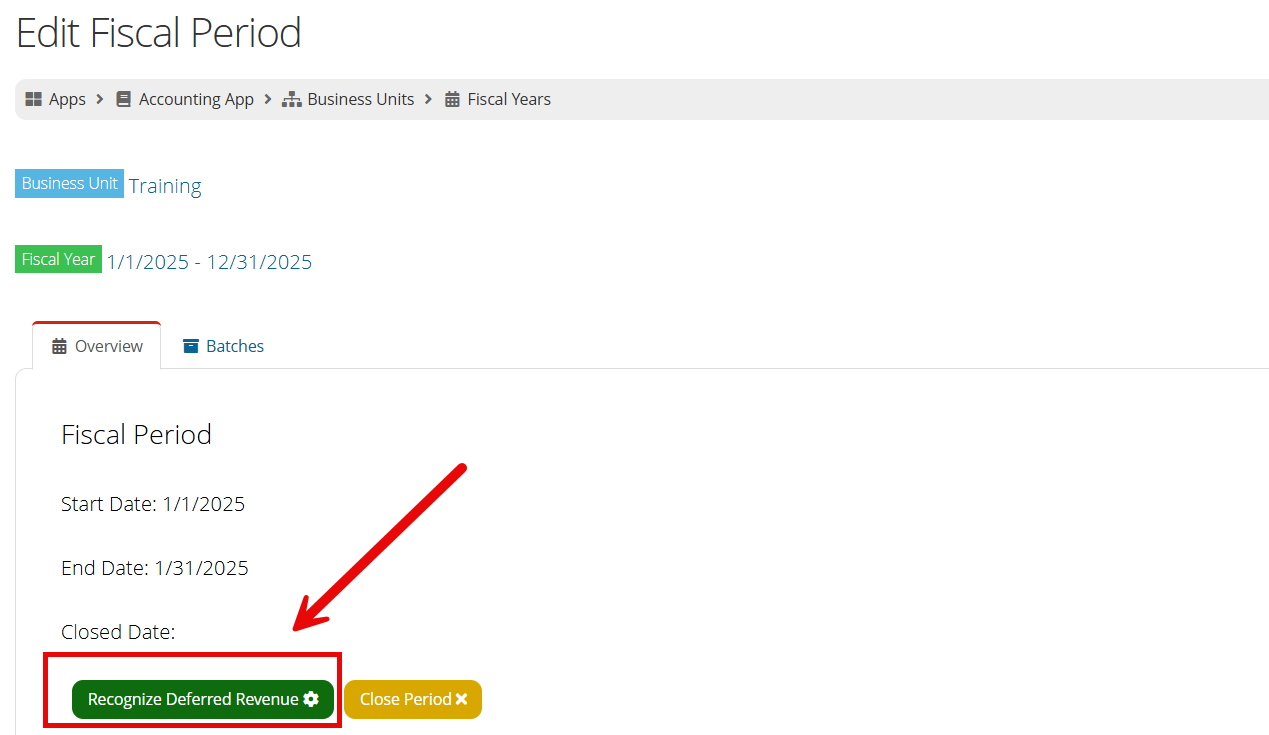

Open the Fiscal Period in which deferred revenue is to be recognized.

-

If any deferred revenue is associated with the fiscal period, the Recognize Deferred Revenue button appears at the bottom.

If this button does not appear, no deferred revenue is associated with the fiscal period. -

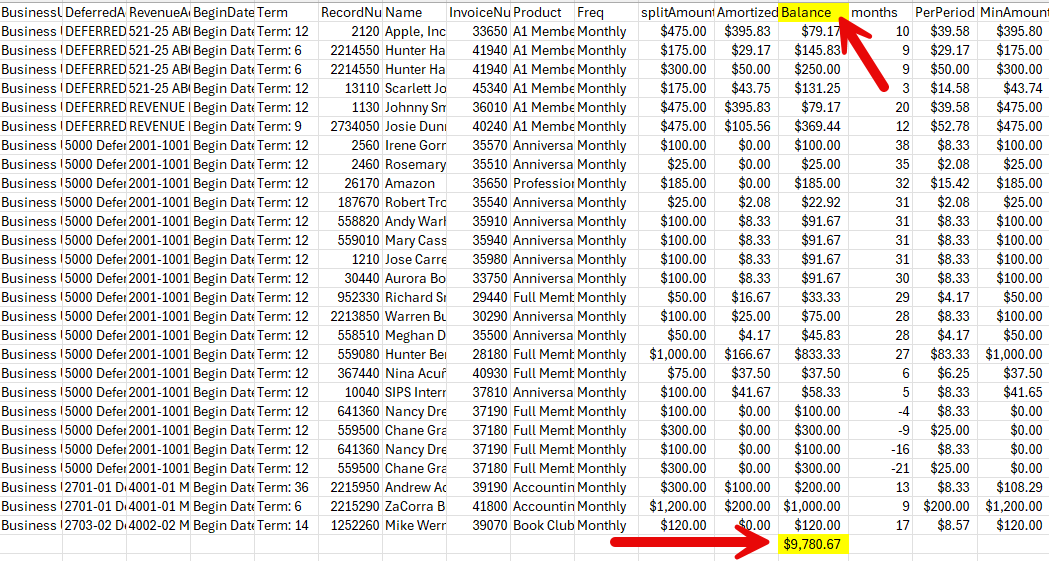

Before clicking Recognize Deferred Revenue, run and save the Deferred Income report. The report is located in the Accounting App > Reports feature.

Tip: Best practice when entering report parameters is to enter the End Date as the end date for the fiscal period being closed which contains the deferred revenue being recognized.

Note: This report lists invoices with deferred funds remaining which should be recognized either this month or in a future month. If the invoice has already been totally recognized, whether it's in a prior month or the current month, it won't show on this report.

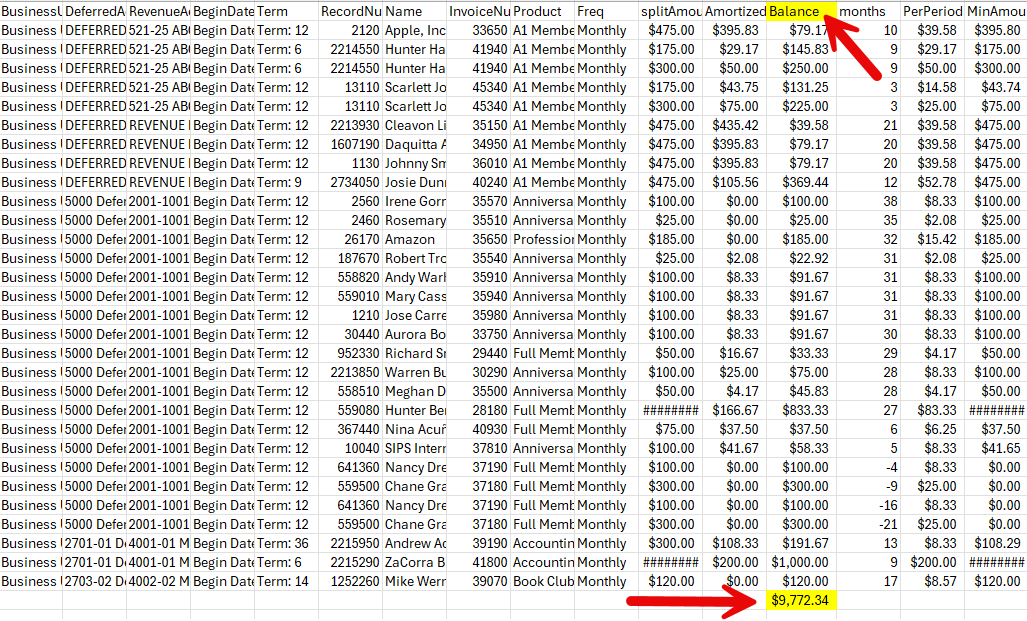

Take note of the Balance column on the Deferred Income report. The total of the balance column for the deferred revenue account should match the balance in the accounting system for that same account.

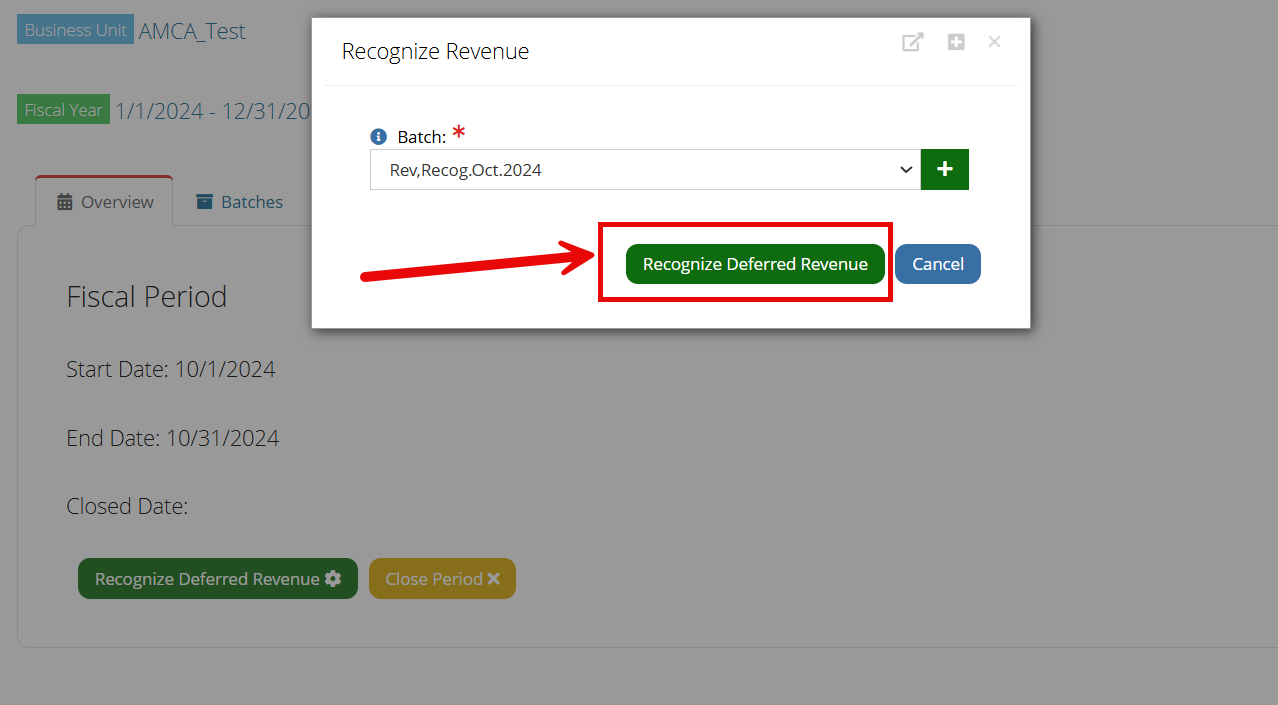

- Return to the Fiscal Period > Overview tab and click Recognize Deferred Revenue to begin the process. The Recognize Revenue window will appear.

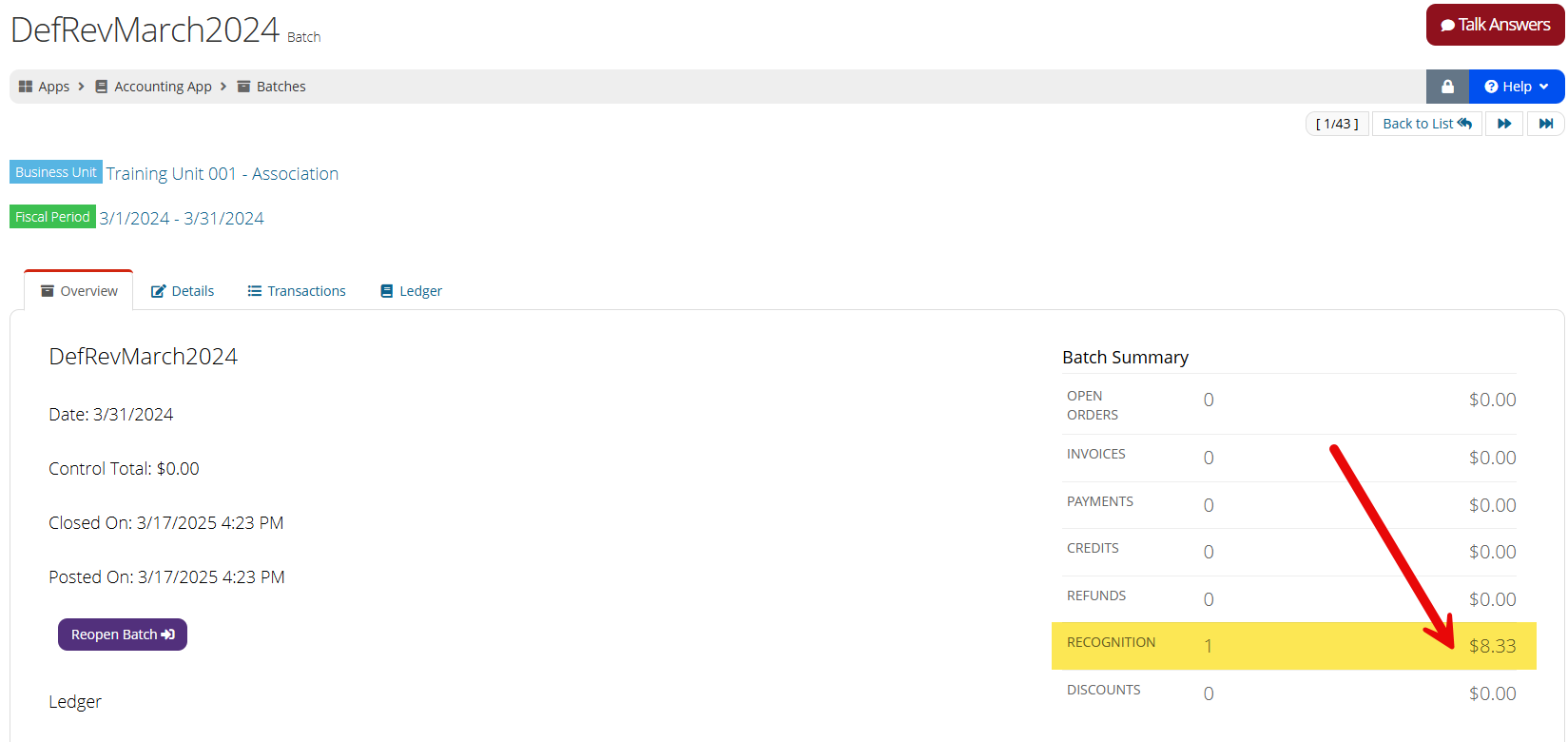

- Within this window, select an existing batch or click the Add button to create a new batch to hold the recognized revenue.

- Click the Recognize Deferred Revenue button and the process will run. This is the process that moves the money from the deferred account to the revenue account.

Note: It may take a few minutes for the process to complete. Please do not attempt to close the deferred revenue batch until the process has finished.

Note: If you are recognizing deferred revenue in the process of closing the fiscal period, the batch created in step 5, above, must be closed and posted before the fiscal period can be closed. See also: Managing Batches in the Fiscal Period.

Once the deferred revenue recognition process is complete, best practice is to rerun the Deferred Income report from step 3 above, using the same parameters. Again, note the balance. When the balance on the first report is subtracted from the balance on the second, the difference will be the deferred amount recognized for the period.